Confidence in Chinese equities remains on a knife edge. Following a dreary year for the economy and its bourses, investor spirits were momentarily fired up late September as China’s central bank announced stimulus measures aimed at boosting its ailing property sector and stock markets – including reduced interest rates and bank reserve requirements on new mortgages, and eased restrictions on borrowing for investing – only for the bulls to retreat as investors pondered what the government would do next.

The answer came a few weeks later, as China’s finance ministry sought to dovetail September’s stimulus by outlining its fiscal commitments to propping up the economy, including support for its property and banking sectors, cash handouts and help for debt-laden local governments. But in absence of detail in fiscal policy announcements, markets do not yet seem fully convinced that the flagging economy can be sufficiently re-energised.

As a result of investor scepticism, the valuations of some of China’s great companies have become very attractive. So why are today’s China concerns creating compelling opportunities, particularly in companies that are able to shield themselves from some of China’s economic issues?

A (value) trap is set

Today’s China opportunity exists because of its problems. The problems are multi-faceted. Growth has slowed, becoming sluggish on account of faltering demand and unenthused consumers. The crisis-hit property sector has turned from an economic boon to a considerable drag, draining confidence in an area that represents about a fifth of China’s GDP and an asset seen as a key repository for long-term savings.

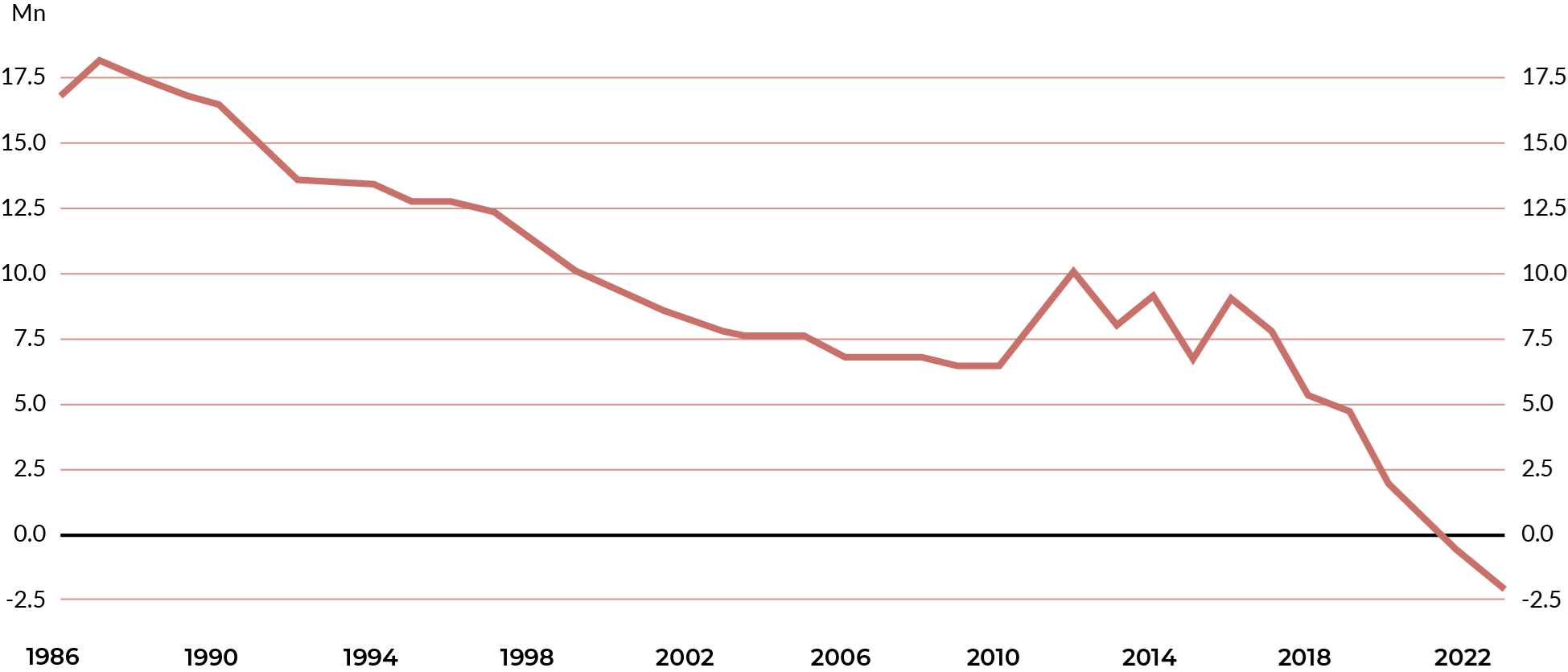

Elsewhere, overbearing regulation has emerged in sectors such as technology and education, spooking international investors. China’s population, restricted by a one-child policy between 1980 and 2015, is ageing and reducing in size – putting consumption, healthcare and tax receipts at risk, remarkable given it used to be one of China’s strongest contributors to growth.

China’s population growth has turned negative

Sources: CNBS, Haver Analytics, Apollo chief economist. Natural population growth shown. Natural population growth = (birth rate - death rate) * total population

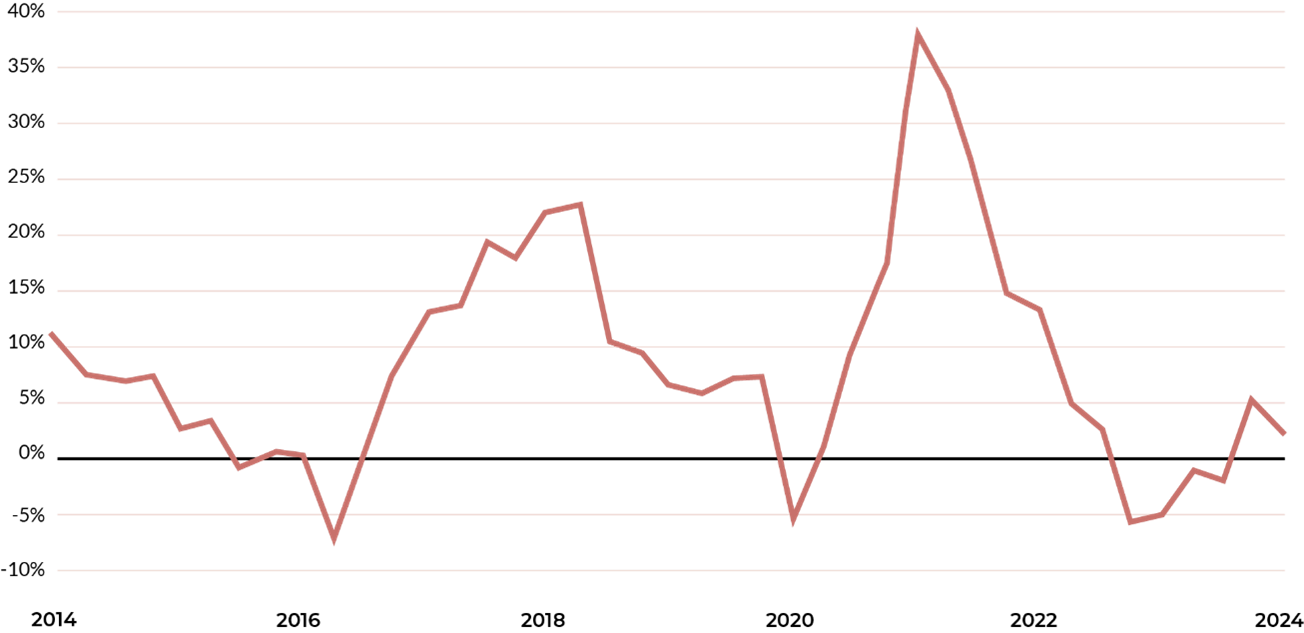

All of this comes at a time of rising geopolitical tensions and fragmentation with the West, with a US-China trade war that hasn’t eased. As a result of this harsh reality, company revenue growth has declined and created risks to earnings forecasts already loaded with uncertainty.

China’s declining revenue growth

Sources: UBS Data, ARGA Analysis; data as of March 2024, MSCI China, HSCEI, CSI 300 included.

Yet, it is in this sort of tricky economic environment that attractively valued companies can emerge. ARGA believes that superficial measures, such as stock price alone, are insufficient to identify potentially compelling investment opportunities. Rather, we seek firms focused on shareholder value, that are on the right side of improving government standards, and that have strong underlying fundamentals offering protection against the wider economic storm.

Other China issues

Economic difficulties aside, China is home to scores of great businesses, plenty that are resilient to its problems.

Even after recent market rallies, company valuations remain depressed, laying the groundwork for ARGA to find attractively valued investment opportunities. But we are mindful of value traps – cheap-looking companies whose share prices justifiably end up going nowhere – and use careful research to avoid them.

In particular, we are finding opportunities in companies falling under China’s wider trend of improving shareholder returns: those that focus on cost control and reducing capital expenditure to improve free cash flow, as well as those increasing share buybacks and dividend pay-outs to create shareholder value.

The government in China, which plays an outsized hand in corporate life, has been encouraging of firms with a shareholder focus. It has a vested interest in the wealth stock markets have created for households, given their growing strategic importance amid the property sector devastation and the mostly domestic ownership of its A-share market.

It’s why the regulator – Chinese Securities Regulatory Commission – has been mirroring moves by regulators in Korea and Japan that have been helping improve capital efficiency within their markets, by stepping up calls for better governance, capital discipline and formal policies for dividends and share buybacks.

At the individual company level, we have been seeking firms with fundamentals that are likely to insulate from broader economic issues. These include solid balance sheets that enable companies to ride out poor trading environments, as well as operational efficiencies and cost advantages that set them apart from competitors.

Tencent, a Chinese internet company, and Alibaba, China’s largest ecommerce company, are examples of attractive investments in the Alliance Witan portfolio. Both have strong balance sheets, with Alibaba holding around $60bn in net cash – equivalent to around 30% of its total market value. Both are focused on improving profitability and shifting capital allocation to prioritise shareholder returns. Both announced share buyback programs in 2024, expected to return around 20-40% of their current market values in buybacks and dividends over the next few years.

Other investments for the portfolio include Prudential plc, an Asia-focused life and health insurer, and Sands China, a resort and casino operator in Macau.

In conclusion, China is clearly complex and troubled, but we believe that with diligent research, market pessimism will continue to create value opportunities and potential for attractive long-term returns for the Alliance Witan portfolio.

Rama Krishna is chief investment officer of ARGA Investment Management, one of the stock pickers within the Alliance Witan trust. The views expressed above should not be taken as investment advice.