The heavy discounts in the investment trust space could pay off for long-term investors willing to go bargain hunting, analysts have argued.

Data from the Association of Investment Companies (AIC) shows trusts have been trading on double-digit discounts for the longest sustained period on record.

The average trust, excluding 3i, is currently on a discount of 14% to its net asset value (NAV) while the average discount has been wider than 10% since 2022.

Annabel Brodie-Smith, communications director at the AIC, said: “Looking back over the past 30 years, discounts come and go in cycles; there have been extended periods of discounts before and times when assets under management have fallen substantially, but discounts have always narrowed and the investment trust sector has always rebounded.

“I don’t see any fundamental reason why this time should be different and therefore many of these discounted trusts could turn out to be bargains for patient investors.”

Below, seven investment analysts pick out the heavily discounted trusts they like the most and explain why they could bounce back.

International Public Partnerships

Andrew Rees, investment company research analyst at Deutsche Numis, started with International Public Partnerships, which is trading on a 25% discount.

“This does not reflect its value,” Rees said. “The diversified portfolio of 140 core infrastructure investments offers long-term, government-backed, largely inflation-linked cashflows, with a high degree of revenue visibility.”

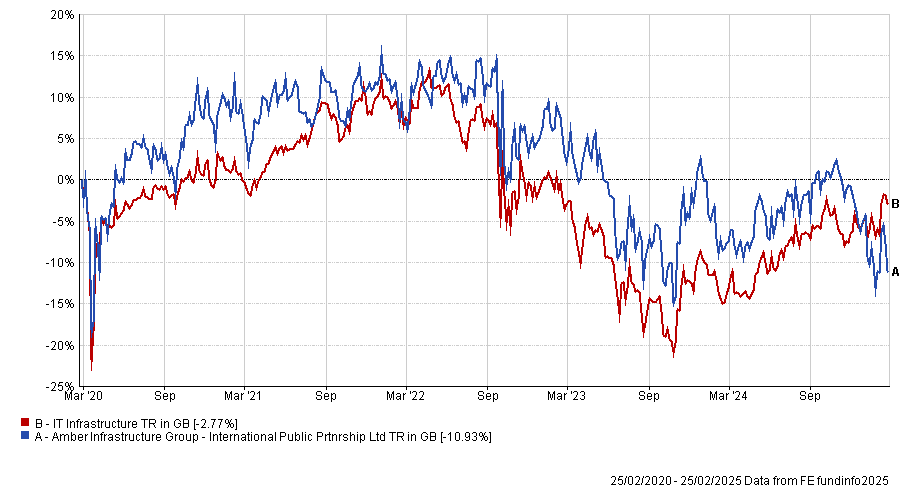

Performance of International Public Partnerships vs sector over 5yrs

Source: FE Analytics

Reflecting this, the trust’s board previously said it could pay a growing dividend for at least a further 20 years even if no further investments are made.

Rees noted that BBGI Global Infrastructure received a recommended cash bid at a 3% premium to NAV, which “highlights the inherent value that can be ascribed to high-quality core infrastructure cashflows, even if this is not currently being reflected by the equity market”.

3i Infrastructure

Sticking with the infrastructure theme, Stifel managing director for investment funds Iain Scouller said 3i Infrastructure -which is on a 15% discount – is a good medium- to long-term holding.

“So what are the attractions?” he asked. “The managers have a good track record of selling investments at good gains over prior valuation. For example, Valorem, a French energy transition company, was recently sold for a 31% gain over its prior valuation.”

In addition, Scouller likes the fact that 3i Infrastructure has no public-private partnership exposure, which means it should be much less sensitive to volatility in the gilt market than other infrastructure funds.

HarbourVest Global Private Equity

James Burns, head of managed portfolio service at Evelyn Partners, opted for HarbourVest Global Private Equity. It is on a 38% discount but is a core private equity recommendation as its ‘fund of fund of funds’ approach provides the most diversified and liquid exposure to private markets.

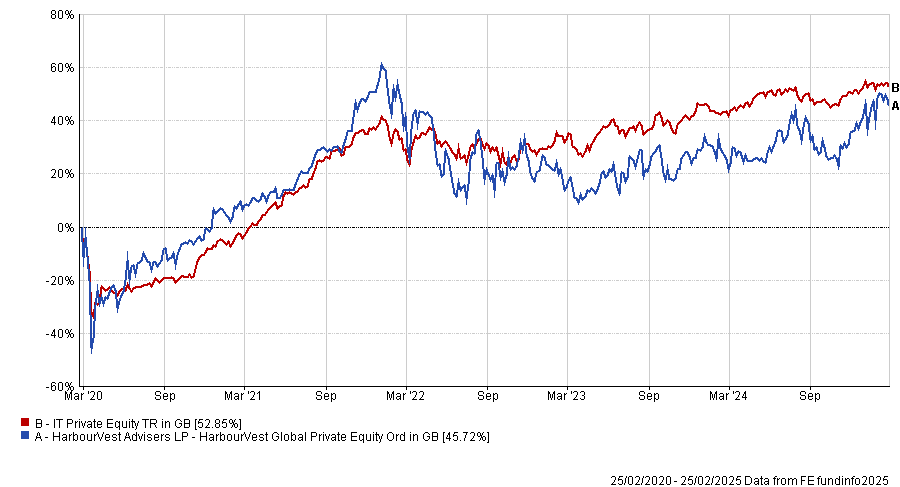

Performance of HarbourVest Global Private Equity vs sector over 5yrs

Source: FE Analytics

While HarbourVest Global Private Equity’s long-term NAV performance has been “exceptional” versus both its peers and listed markets, the trust’s share price has been more volatile and less impressive.

“This is a common issue for all the listed peers. In response, the board has recently come out with a series of initiatives to increase returns to shareholders,” Burns explained. “We are hopeful that these will begin to feed through to a much tighter discount trading range.”

Baillie Gifford Shin Nippon

Shore Capital research analyst Rachel May pointed to Baillie Gifford Shin Nippon and its 15% discount as an attractive opportunity, because it is now the only trust offering pure exposure to Japanese smaller companies.

Historically, the trust has traded at a material premium to its benchmark. However, it has struggled more recently because its high-growth, small-cap portfolio was left behind while larger companies outperformed.

“We argue that the extended period of underperformance experienced by Baillie Gifford Shin Nippon is likely to reverse when the trust’s growth strategy comes back into favour, which should trigger a significant rerating of the portfolio and narrowing of the discount,” May said.

Seraphim Space

Seraphim Space was one of the best-performing trusts in 2024 but is now on a 37% discount, despite its portfolio companies continuing to sign long-term revenue-generating deals with major government agencies.

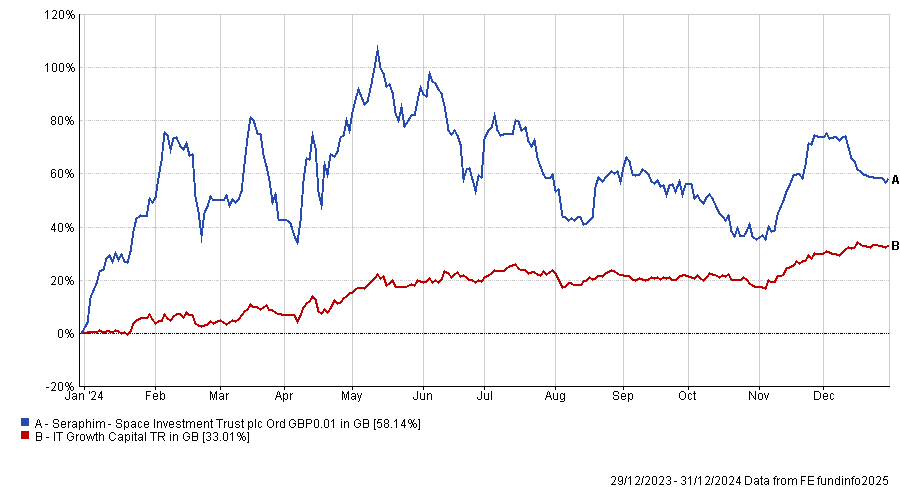

Performance of Seraphim Space vs sector in 2024

Source: FE Analytics

However, Winterflood Securities research analyst Shavar Halberstadt pointed out that the trust is one of the few publicly traded ways to attain pure-play access to the space tech theme, which benefits from strong tailwinds such as rising global defence expenditure and wider investments in the space domain.

“If the managers’ guidance on portfolio companies achieving positive earnings is maintained, we believe that its prospects are strong and the discount should narrow over the medium term, particularly as IPO volumes normalise,” he said.

Gresham House Energy Storage

James Wallace, research analyst at Winterflood Securities, said that Gresham House Energy Storage’s 58% discount comes from a challenging period caused by the collapse of UK battery revenues.

The trust has suspended its dividend while it completed its construction projects, but these are expected to be finished by the end of 2025’s first quarter. Meanwhile, battery revenues are improving and this is expected to result in a return to dividend payments later in the year.

Molten Ventures

Finally, BRI Wealth Management chief executive Dan Boardman-Weston picked Molten Ventures, which is also trading on a 58% discount. The trust invests in disruptive and high-growth technology companies across Europe, which were hit hard by higher interest rates and the sluggish economy.

“Looking ahead, the disruptive businesses they invest in are well positioned to continue growing strongly, which will drive the NAV higher,” he finished. “When this is coupled with portfolio realisations that support the NAV and proceeds being used for share buybacks, the outlook seems very positive.”