Everyone wants to save money, whether it be hunting for the best deals when buying items, getting several quotes from tradespeople or investing.

The obvious ways to do this are to buy cheaper funds and use cheaper platforms, but there is a foolproof way to save money that fewer people seem to be using this year.

It is known as Bed & ISA, a phenomenon that simply involves transferring assets held outside of a tax wrapper into an ISA, so that future investment growth and income are sheltered from tax.

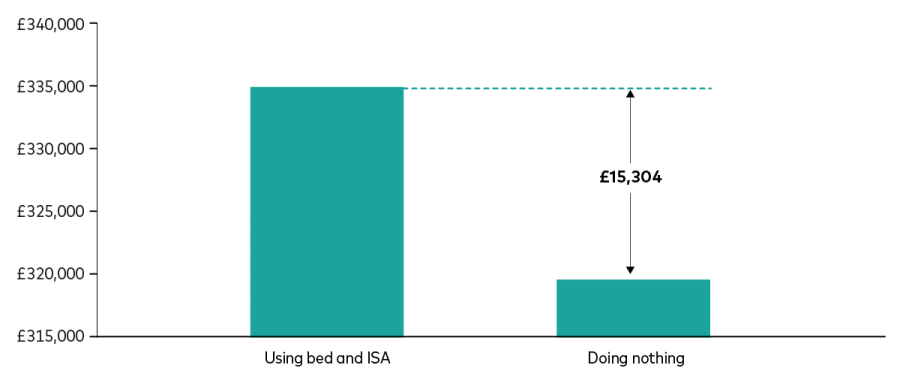

While it may sound simple, the benefits it can bring are enormous. Data from Vanguard published towards the end of last year showed it could save investors up to £15,000 over 10 years, as the chart below shows.

To do this, the firm assumed an investor started off with both a general investment account and an ISA, valued at £100,000 each. They invested in a portfolio which returned 5% a year after costs and sold the investments after 10 years, paying capital gains tax (CGT) due on the remaining general account balance.

However, if they had moved the maximum £20,000 from their general investment account into an ISA every year for five years, the individual would have ended up with £15,304 more, despite holding the exact same investments.

James Norton, head of retirement & investments at Vanguard Europe, said: “Bed & ISA is an effective tool that could be making investors that additional amount to reach long-term goals. This is one example of where paying attention to allowances can significantly deliver for investors.”

The difference between using Bed & ISA and not over 10yrs

Source: Vanguard

Yet despite seeming like a no-brainer, fewer investors are using this tax tip, according to data from interactive investor.

Bed & ISA transactions are down 40% so far in 2025 compared with last year. This is important because most of these transactions take place in the final few months before the end of the tax year.

One reason may be that investors have done this early. In 2024 there was a record-breaking summer and third quarter for Bed & ISA transactions as speculation of a rise in capital gains tax in the 30 October Budget ramped up. The CGT rates were subsequently increased to 18% and 24% for basic and higher-rate taxpayers, respectively.

Myron Jobson, senior personal finance analyst at interactive investor, said: “The rush to Bed & ISA came earlier than usual, but the reality is that anytime is a good time to shelter investments within the tax-efficient ISA wrapper.

“With the capital gains and dividend tax allowance less generous than they were in recent history, making full use of the ISA’s shield against capital gains and dividend taxes should be a priority for investors looking to maximise returns over the long haul.”

This is an annual reminder therefore that, if not done already, finding any way to maximise ISA allowances will save money in the long run.

Those with investments elsewhere should look to top up their ISAs from their general investment accounts. Do not sleep on the Bed & ISA.