China is an essential trade partner for the world, which has come to rely on its low-cost, decent-quality goods – and the US is no exception, according to Sammy Suzuki, FE fundinfo Alpha Manager of the AB Emerging Markets Multi-Asset Portfolio and the SVS Alliance Bernstein Low Volatility Global Equity funds. “The entire US economy cannot sustain itself without products from China,” he said.

Donald Trump’s tariff climbdown this week suggests he may have come to a similar conclusion. The US president had already exempted electronic imports from tariffs, sparing China from an extreme scenario in which people could no longer buy smartphones.

“In the modern era, if consumers can't access their smartphones, there would be riots. I don't know if that would have been politically wise – which is probably why Donald Trump had backed down on the electronics portion of the tariffs,” said Suzuki.

(In a similar vein, Iain Stealey, global fixed income chief investment officer at JPMorgan Asset Management, told Trustnet that if Trump had stuck to his guns and maintained extortionate tariffs on China, the resulting economic slowdown could have pushed the US into a recession.)

China’s economy is more resilient to disruptions in trade flows than investors may think, Suzuki continued. The current trade wars are only the latest chapter in a long story. Trump has been tightening the noose on China since he introduced tariffs during his first term but, despite his best efforts, China’s share of global exports has actually increased by 150 basis points during the past five years, he said.

China has maintained its dominant position in global trade by shifting its focus away from the US, towards countries such as Mexico and Vietnam, whose share of global exports increased by 20 basis points during the past five years. China’s continued dominance over global trade has encouraged Suzuki to keep faith. He has been identifying opportunities in the country for over a year, even as markets have moved in the opposite direction.

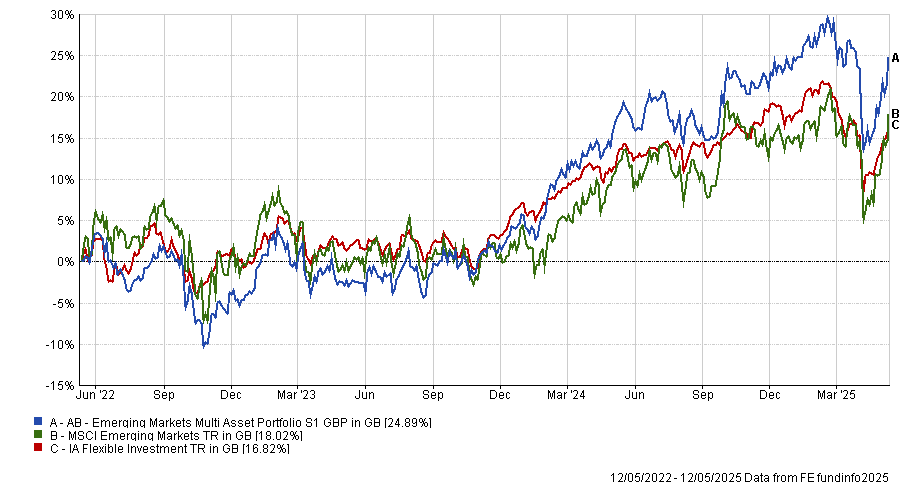

This has paid off since 2024, when the AB Emerging Markets Multi Asset Portfolio jumped ahead of the benchmark and of its peer group, as the chart below shows.

Performance of fund against index and sector over 3yrs

Source: FE Analytics

“A year ago people were saying that nothing good is happening in China and we should be overweight India just like everybody else, but that's not how we have been positioned,” he said.

The manager is convinced that country selection doesn’t drive returns as much as stock selection does, so he is focusing more on the 600 stocks that are available to buy in China.

“Is it possible that every single one of them are bad investments, or is it possible that because most people don't like China, there are 10 or 20 companies that are good investments that are being overlooked?”

In particular, he has identified three buckets: exporters, domestic growers and high-dividend yielders.

Companies in the third bucket are often value stocks and can be state-owned enterprises trading at a discount. “These are good, steady businesses with a 6% or 7% dividend yield, which the government is trying to restructure to improve the corporate governance and encouraging to pay out dividends a little bit more,” Suzuki explained.

“That can have a huge impact on the valuation, once they demonstrate that they're doing some of these things. So that's an opportunity.”

China and its companies have shown resilience, and even the most feared scenario among shareholders – a potential invasion of Taiwan – doesn’t overly concern Suzuki. “An invasion isn’t likely,” he said, adding that China’s dominance in global trade might even withstand such a crisis. “Even if China goes down that path, would we really stop all imports from the country? I’m not so sure,” he concluded.