After years in the shadow of large-caps, mid-sized, domestically focused companies are gaining traction once again with investors. This is certainly true for Fidelity International's multi-asset manager George Efstathopoulos, who highlighted mid-caps as key beneficiaries of changing global dynamics.

Larger companies, once buoyed by globalisation, may be more exposed to the downsides of decoupling and protectionism, while those further down the market-capitalisation scale offer exposure to a different set of forces, including domestic industrial policy, reflation and regional recovery cycles.

“The rise of tariffs and protectionism is hastening regionalisation, prompting a significant restructuring of supply chains and a move towards onshoring,” Efstathopoulos said.

"Mid-caps are positioned to benefit from such domestically-driven industrial policies, infrastructure projects and capital expenditure cycles, which align well with current economic trends.”

On top of that, the valuation gaps between mid-cap and large-cap stocks are historically wide at present, suggesting that mid-caps may be undervalued across the globe.

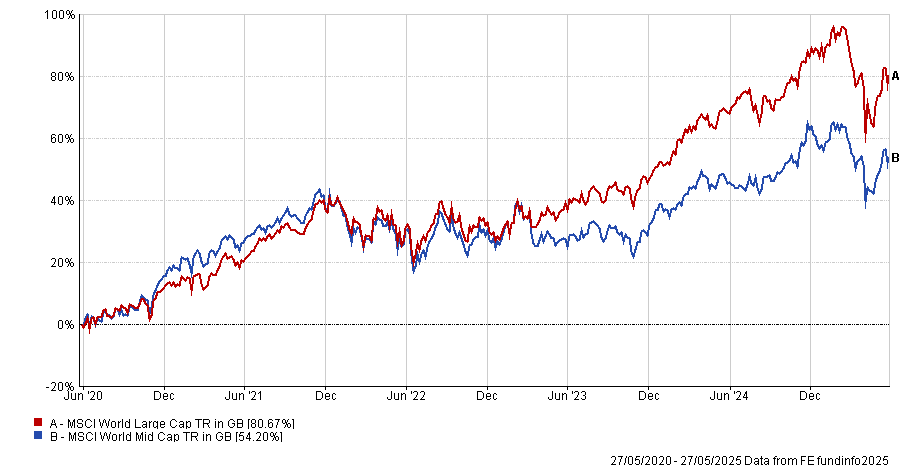

Over the past five years, for example, the MSCI World Mid Cap index has made 54.2%, some 26.4 percentage points behind their large-cap rivals, as the chart below shows.

Performance of indices over 5yrs

Source: FE Analytics

There are three regions however, where these dynamics are particularly compelling: Germany, Japan and China – where mid-caps have even closer ties to the improving local economies.

In Germany, the government is moving away from its traditionally tight fiscal stance, including spending more on defence in the wake of the outbreak of war across the world (and in particular the Ukraine-Russia conflict). This should benefit cyclical sectors where German mid-caps are heavily concentrated.

“These companies have a stronger correlation with PMIs [Purchasing Managers’ Indices], given their heavy industrial focus, and seem to have reached a low point,” the manager said.

But it is not just German politics where there are signs of change. The European Central Bank is on an easing trajectory and mid-caps tend to be more responsive to short-term interest rates, said Efstathopoulos.

With further easing anticipated in the coming quarters “this environment is favourable for mid-caps, whose earnings are more sensitive to GDP growth compared to large-caps”, he said.

Meanwhile, in Asia Japan presents another promising case. After decades of economic stagnation marked by low growth and inflation, wage-driven reflation is beginning to take hold. Rising real wages are fuelling domestic demand and changing consumer behaviour, lifting the outlook for companies tied to the local economy.

“Japan's mid-cap stocks offer a compelling investment opportunity; they are largely insulated from currency volatility, making them a stable choice,” he continued.

“This favourable economic climate is reflected in improving fundamentals, as demonstrated by rising return on equity and profit margins among mid-cap companies.”

This pairs with the ongoing narrative of structural corporate reform in Japan, which also seems to be benefiting mid-caps, as the “significant” increase in dividend yield shows.

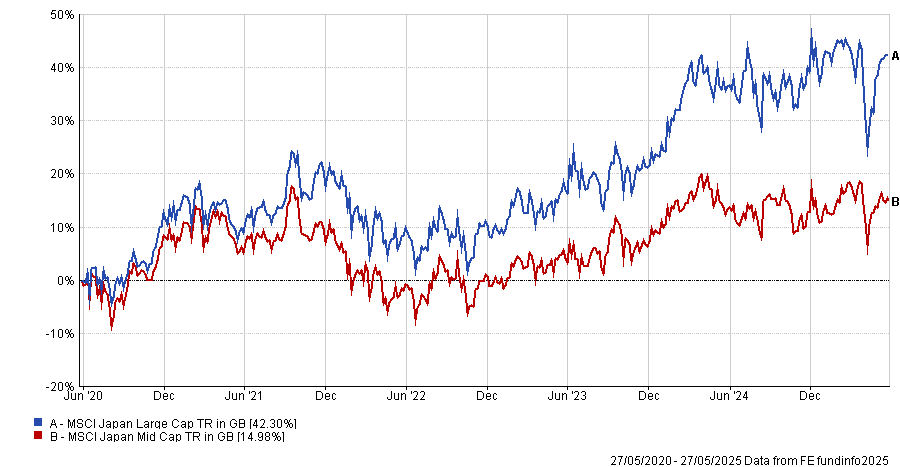

And they are coming from a low base, with the MSCI Japan Large Cap index up 42.3% over the past five years, while the MSCI Japan Mid Cap benchmark has made just 15% - a difference of some 27.3 percentage points.

Performance of indices over 5yrs

Source: FE Analytics

Staying in Asia, in China the conversation is shifting from export-driven growth to domestic consumption. With monetary, fiscal and regulatory policies all turning more supportive, the government seems ready to stimulate internal demand.

“China is probably the only market globally where we see easing across monetary, fiscal, and regulatory policies,” the manager said. “By using its fiscal capabilities to combat deflation and rebalance the economy, China can cultivate sustainable domestic growth, positioning onshore mid-caps as prime beneficiaries.”

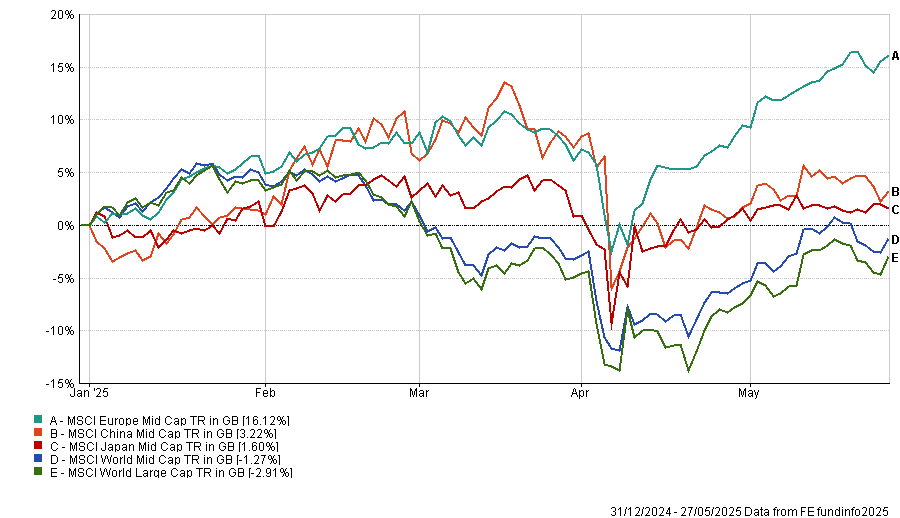

Despite the drivers mentioned above, mid-cap performance has been a mixed bag so far year to date. European mid-caps have led the recovery, as the chart below shows, but Efstathopoulos there is a long way for this to run in the future.

Performance of fund against index and sector over the year to date

Source: FE Analytics

“These markets are undergoing multi-decade, if not generational, shifts in dynamics, offering compelling investment opportunities,” he concluded.