The global economy is undergoing a seismic shift and investors clinging to traditional approaches may be walking into danger.

According to Brian Dennehy, managing director at Dennehy Wealth, “buy and hold is a dangerous approach in this environment”. Earlier this morning, he argued that a bear market is now more likely, with sharp declines and brief recoveries marking a drawn-out transition from bull-market complacency.

Today, investors should focus on navigating this shift, which requires more than minor tweaks to portfolios and a complete new way to think about diversification.

“For much of the past 40 years, diversification was theoretical and a bit of a myth,” Dennehy said. “Everyone thought they were well diversified by investing 60% in equities and 40% in bonds. That wasn’t diversified at all, because both were driven by the same factors – falling inflation and falling interest rates.”

Below, the financial adviser shared his asset allocation ideas and the perfect portfolio to express them, with a selection of funds serving as examples.

“This is a more suitable mix than many of those that we've all been employing for the past number of years and it's designed for this transition period of market flip flops, of considerable uncertainty, inflation volatility and of entrenched vulnerability.”

All of the percentages and fund picks are not a strict prescription, he added, but rather a framework to help investors think more deliberately about risk.

Dennehy’s portfolio for real diversification

Source: Dennehy Wealth

The equity sleeve

Dennehy suggested that equities – specifically those offering clear value, regardless of style – could form up to 30% of a diversified portfolio. “Having a maximum 30% in equities is certainly not regarded as aggressive, on the contrary,” he said.

The equity sleeve is where investors can use momentum to choose funds that invest in his four preferred regions: the UK; Asia; Japan; and China. Exchange-traded funds (ETFs) are his preferred method to access these markets.

“Intraday dealing has become increasingly important in the environment we're in,” Dennehy explained.

This part of the portfolio will also capture some US upside as all of the above have some correlation to the US, but will come with “less downside when the US collapses”.

China is the exception to this rule, however, as it less dependent on the US and can power on independently. It is “undoubtedly” where investors can make the most money, he said, as long as they can accept volatility. Dennehy’s pick here was the iShares China Large Cap UCITS ETF.

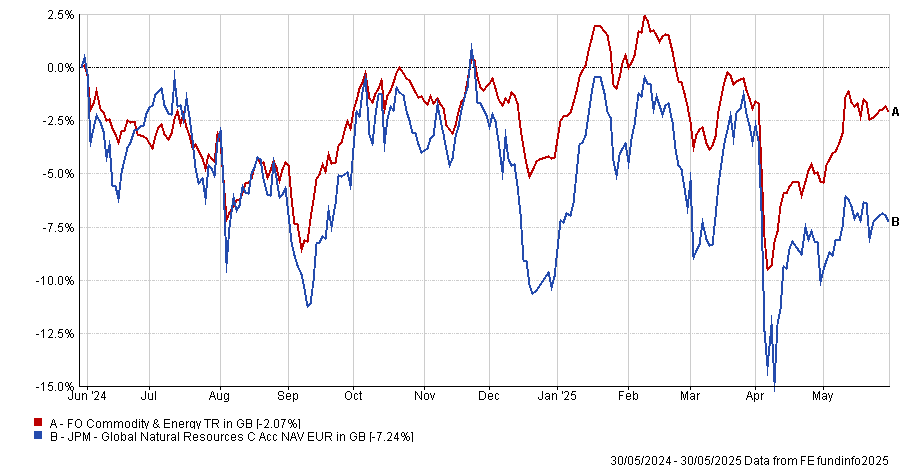

Commodities and real assets

Commodities and real assets make up about 20% of Dennehy’s portfolio, providing inflation protection and some shock resilience. One way to populate this segment would be to buy one diversified commodity fund, for example the JPM Global Natural Resources.

Performance of fund against index and sector over 1yr

Source: FE Analytics

More sophisticated (and risk-tolerant) investors might want to focus on gold, for example, where Dennehy suggested a 50/50 split between gold and gold miners.

An alternative would be to invest half this segment in gold and the rest split between oil and oil equities (both of which are “very cheap” at the moment) and other things such as platinum or uranium.

“These areas are very volatile, so investors should only get involved if they are comfortable with high risk, can follow the market closely and apply stop losses”, he warned.

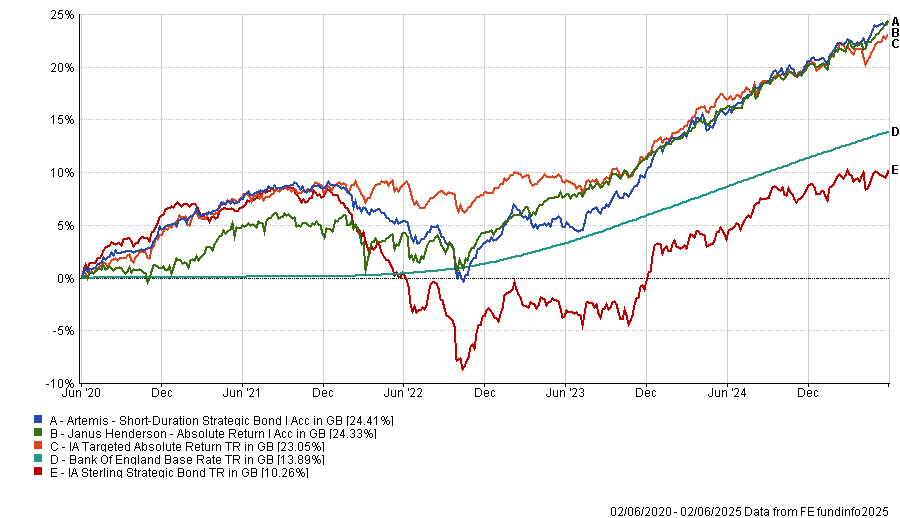

Low-volatility funds

The purpose of this section, which takes up 20% of the adviser’s portfolio, should be to take advantage of the “limited link, if any”, to the US stock market that funds in the IA Absolute Return, the IA Strategic Bond, the IA Mixed Investments 0-35% Shares and potentially the IA Specialist sectors have.

Most have the ability to perform in almost all market conditions, and investors should allocate “a small selection with different styles”.

“The best funds in both the absolute return and strategic bond sectors can really pay off now – their time has come,” Dennehy said, giving Orbis Cautious, a fund with a maximum FE fundinfo Crown Rating of five, as an example.

A tip for finding funds with low volatility is to look at their performance charts, such as the one below of the Janus Henderson Absolute Return and Artemis Short Duration Strategic Bond funds.

“You can almost observe the low volatility as both these funds look quite steady,” he said.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Index-linked bonds and cash

A 10% allocation to index-linked investments acts as a shock absorber in an environment where “there will be plenty of shocks”, and provides inflation protection without the volatility of gold.

Here, the areas to pick from would be the UK, the US and global funds, either through active management or ETFs. The percentage allocated to cash was 20%, with the option to invest in opportunities as they arise, or just “to help you sleep better at night”.

Stop losses and stop profits

Dennehy stressed that it is not just about the asset allocation and fund choices, but also investor discipline.

“Stop losses are absolutely vital, and a stop profit will be too. Take profits more quickly where you can, because in this period, profits quickly made can also be pretty quickly lost,” he said.

“Markets are going to swing by and they're going to swing fast. ‘Buy and hold’ is dangerous, and protecting gains is as important as cutting losses”.