The UK and parts of the emerging markets could become more attractive to investors if the US exceptionalism trade continues to falter, RBC Brewin Dolphin argues.

The recent underperformance of US markets has sparked a provocative question: Is this the end of American exceptionalism?

In 2025 so far, the US market has made a 5.2% loss while the rest of the world logged a 6.8% gain, according to RBC Brewin Dolphin analysis.

This shift has coincided with increasing investor scrutiny of the US economic and policy outlook and could be seen as a disappointing end to a historically strong track record.

The US equity market has outperformed the rest of the world 30 out of the last 50 years. Over the past 15 years, the rest of the world only outperformed the US in 2017 and 2022 as the meteoric rise of tech stocks and the so-called Magnificent Seven companies kept the US far ahead of its rivals.

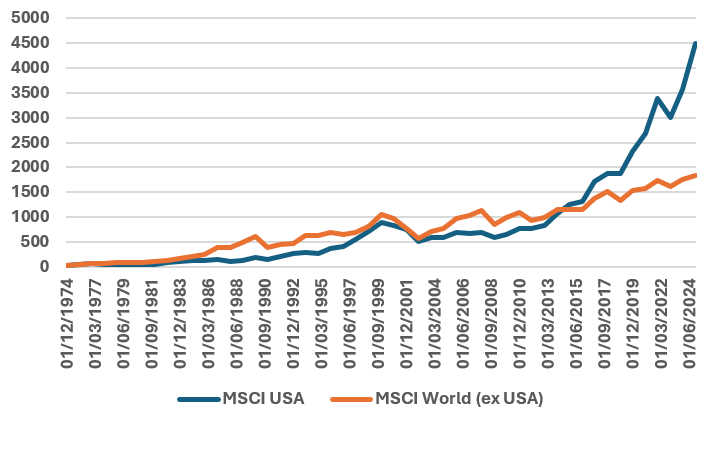

Since 1974, the MSCI USA index has returned 25,833.6% (the equivalent to 11.8% annually), compared to 10,311.9% (9.7% annually) for the MSCI World ex USA.

MSCI USA vs MSCI World ex USA since 1974

Source: Bloomberg, RBC Brewin Dolphin

What does it mean to be ‘exceptional’?

The term ‘American exceptionalism’ first emerged in the 1920s – essentially referring to the outperformance of US stocks compared with the rest of the world.

The country’s strong track record can largely be attributed to a strong culture of innovation and entrepreneurship, flexible labour markets, higher productivity (i.e., producing more with less) and strong consumer demand driving goods and services, bolstered by a favourable regulatory environment, lower corporate taxes and more open markets and trade policy.

This culture has come under increasing pressure in 2025, thanks to president Donald Trump’s looming tariffs and volatile foreign policy spooking markets.

With confidence in American exceptionalism now wavering, there is a growing argument for investing in the rest of the world outside of the US. Rob Burgeman, wealth manager at RBC Brewin Dolphin, has identified four key regions that could stand to benefit.

The UK and EU

Trump’s criticisms on defence spending forced an overhaul in the EU’s spending priorities which has, in turn, made the region more attractive.

“The change in rhetoric from the US when it comes to Europe’s defence has prompted a lot of the continent’s governments to reassess their spending priorities – perhaps most notably is Germany’s €500bn commitment to infrastructure and defence, which was rubber stamped earlier this year,” said Burgeman, noting that the valuation gap between the US and Europe could begin to narrow.

However, not every country across the bloc will benefit in the same way “and the same can be said for industries within the nations that do”, he said.

Meanwhile, the UK market has long been dismissed in the global growth story, thanks to the FTSE’s heavy tilt towards value stocks and the damaging impact of Brexit.

Despite this, the UK is “looking like a more attractive market” for investors hunting for opportunities beyond the US, due to its “comparatively stable policy environment” and generally high-quality defensive companies across banking, energy, pharmaceuticals and other industries.

China and emerging markets

China has rapidly emerged as an “interesting place to invest”, according to Burgeman.

It may still be recovering from a bruising property crisis and the legacy of Covid-era restrictions, but the country is also seen as a frontrunner in artificial intelligence (AI) implementation, he said, meaning it is one of the few regions that can offer similarly scaled alternatives to US tech giants.

“What is good for China is often good for the wider Asia-Pacific region as well – an area that is difficult to disentangle from the broader category of emerging markets,” Burgeman said.

A weaker dollar will also be good news for both Asia and emerging markets more broadly, as much of their debt is denominated in US dollars, Burgeman explained.

“That frees up capital that can be invested elsewhere in rapidly growing markets, while any tariffs placed on China will likely see manufacturing moved to Vietnam, India and other countries, which can only be to their benefit.”

Are we about to see the ‘great rotation’?

In the years to come, returns may well be better in markets outside of the US but that doesn’t mean the American dream is down and out, Burgeman insisted.

Rather, this is about broadening the field, not abandoning it.

“It is not a zero-sum game – just because other markets perform better doesn’t necessarily mean the US will suffer,” he said.

“Disinvesting from the US means cutting exposure to some of the biggest and most successful tech companies in the world and few other markets have any equivalents or competitors of similar scale.”

So, the real story may not be a dramatic dethroning of US markets, but a more balanced global investment environment.