There are three key tenets to picking a passive fund, according to model portfolio service provider Sparrows Capital: the size of the fund house, cost and track record.

Passive investing has become increasingly popular over the past 20 years, with money piling into funds that aim to replicate the performance of a benchmark rather than active managers who aim to outperform it.

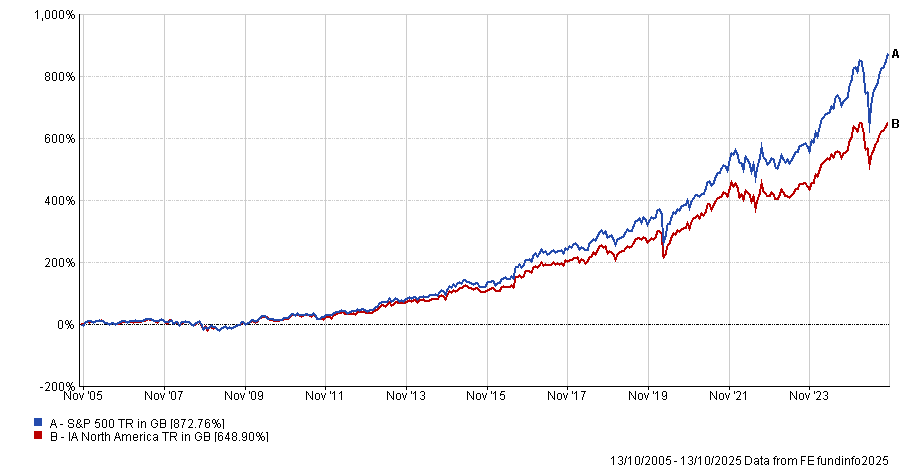

This approach has gained particular traction over the past two decades, as the US has been the best place for investors to put their cash. The market has been driven higher by a narrow set of tech stocks and, as a result, the S&P 500 (led higher by these few companies) has made 872.8% over this period while the average fund in the IA North America sector has gained just 648.9%.

Performance of index vs sector over 20yrs

Source: FE Analytics

However, the trend of investing in the market rather than trying to beat it is a tried-and-tested one that has worked for more than a century, according to David Ogden, compliance officer at Sparrows Capital.

The firm’s thesis is that investors will not outperform over any substantial length of time unless they are “extremely lucky”.

“The chances of outperforming over a long period of time are so close to nil as to be disregarded,” he said.

As such, the wealth manager uses a completely passive approach, with three distinct ranges: Responsible, Factor and Market. There are 10 portfolios in each, ranging from 0% in equities up to 100%, with each step up the risk scale adding 10% to stocks.

However, picking a passive fund is not always as simple as it may appear. With a plethora of options available, Sparrows Capital uses three main criteria for deciphering which product is more suitable for clients.

The first is the track record of the fund house providing the passive product. “We want to know that they are good at tracking what they are supposed to,” Ogden said, meaning the firm places a heavy weighting to the tracking error over time of the vehicle.

Some passive funds can outperform their market by loaning out shares to short sellers, but over time he said this was “marginal” and should not impact the returns of a tracker.

Any passive fund that has a track record of making more money than the index it is replicating would get an “amber flag” as this is not supposed to happen.

“If there are short little blips in there that don’t disadvantage the client [then we are not concerned] but we’d almost be suspicious if a tracker beat the market over a long period of time,” he said, as the firm is looking for “the market return less costs”.

Next is the size of the fund group (and fund) in which the firm invests. Here, Ogden said the firm does not want to be the dominant investor in a fund, as this can increase the risk that the firm might need to switch out of the fund for factors outside of its control.

“We tend to only use underlying instruments from very large houses like Vanguard and HSBC,” said Ogden, who added that there was “nothing esoteric” in the portfolios.

“What we don’t want to do is switch too often because that costs us in terms of time and admin and it costs the client.”

The third criterion is fund charges, which he described as “absolutely crucial” because the firm wants to keep its own charges low.

Fees can vary wildly. Analysts at AJ Bell found earlier this year that the most expensive tracker on the market for UK stocks costs 1.02% - some 97 basis points more than the cheapest at 0.05%.

Stock market trackers typically cost between 0.1% and 0.24%, with the emerging markets the most expensive place to invest in a passive fund on average, they found.

Earlier this year, Trustnet revealed the cheapest funds for cost-conscious investors to give an indication of the best-value options in a range of different markets.

This eye on costs means financial advisers can access Sparrows’ models for 10 basis points plus the costs of the underlying holdings, which range from 8 to 24 basis points.

However, cost is not everything, Ogden said, noting that a blend of all three points was critical for investors. “Is cheap the same as value? Definitely not.”

He gave the example of a new S&P 500 tracker coming to market charging 1 basis point less than the current option already used in the MPS. This would not necessitate a change, even though there is a difference in price.

“It could cost more than 1 basis point to switch,” he said, adding that the firm would need to see a long track record.

“It is important that they demonstrate they can do what they do over a period of time and not just in the blink of an eye. There is no merit for us or our clients in switching every five minutes.”