US president Donald Trump’s erratic policymaking has unleashed a stock market sell-off in recent days, amidst concerns about tariffs, a potential slowdown in the US economy and excessive valuations.

Kallum Pickering, chief economist at Peel Hunt, said: “Trump’s erratic on-again-off-again approach to anti-growth trade tariffs, combined with a sudden weakening of economic data, has markets asking: is the US economy merely slowing or heading into recession? The worries have badly jarred market confidence.”

Markets hate uncertainty, agreed Mark Hawtin, head of Liontrust’s Global Equities team, so have reacted badly to the “kaleidoscope of policy changes and about turns from Trump”.

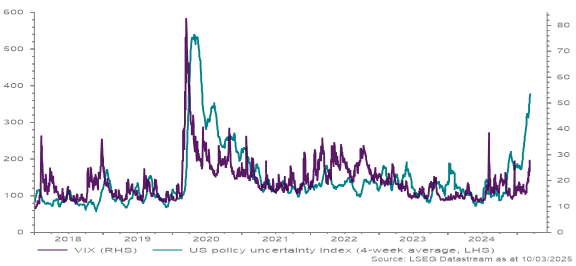

Uncertainty over the direction of US policy is approaching levels last seen at the onset of the Covid-19 pandemic, as the chart below from Royal London Asset Management (RLAM) shows.

US policy uncertainty and S&P 500 volatility

Source: Royal London Asset Management

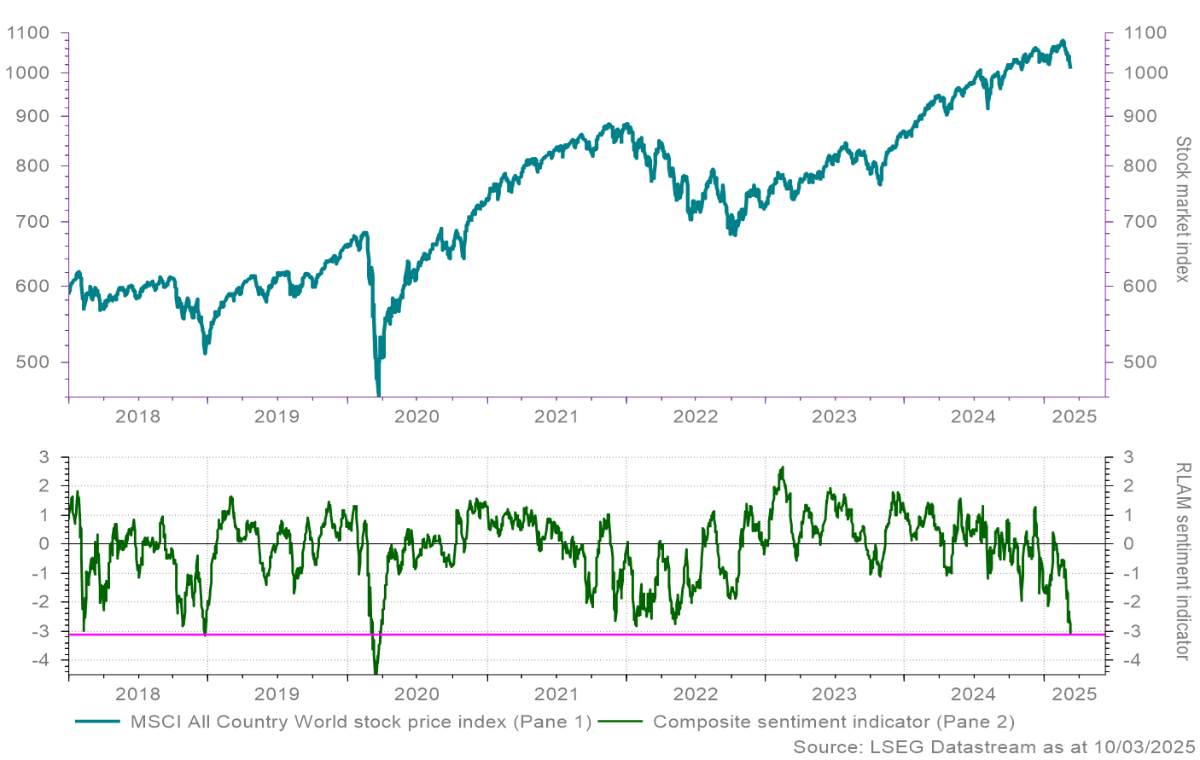

RLAM’s daily investor sentiment indicator is now at its most depressed level since the pandemic, with Monday 10 March registering as one of the 50 most extreme days since 1991.

RLAM composite sentiment indicator and global equities

Sources: Royal London Asset Management, LSEG Datastream. The RLAM proprietary Composite Sentiment Indicator takes into account measures related to stock market volatility, private investor sentiment and company director buying. A reading of zero reflects average sentiment.

How should investors react and what funds should they choose?

Stephen Dover, Franklin Templeton’s chief market strategist, urged investors to diversify in the face of uncertainty. “If the [US] economy continues to slow, we believe longer maturity Treasury and high-quality corporate bonds will likely perform well, offsetting potential drawdowns in equity and commodity markets. Select areas of high yield and private credit also offer supportive income,” he noted.

“Diversifying beyond the Magnificent Seven and outside the US equity market has become more essential than ever,” he continued. “Fiscal stimulus in Europe and China, for example, offers scope for regional market returns to decouple.”

Tom Stevenson, investment director at Fidelity International, agreed that the US sell-off highlights the importance of diversification to mitigate risk and improve portfolio resilience. He suggested three funds for investors seeking to build diversified ISA portfolios: Dodge & Cox Global Stock; Fidelity Global Dividend; and Brown Advisory US Smaller Companies.

Dodge & Cox Global Stock invests in medium-to-large, well-established companies across developed and emerging markets. The manager aims to buy companies when they are temporarily undervalued but have a favourable outlook for long-term growth.

Fidelity Global Dividend offers geographic diversification by being underweight the US. Dan Roberts, who has managed the fund since 2012, has a bias towards traditional defensive sectors, such as consumer staples, pharmaceuticals and healthcare, and limited exposure to more cyclical areas, such as basic materials and retail.

“He manages a low turnover, high conviction portfolio with a focus on income, attractive valuations and visibility of returns. He looks for a margin of safety and the ability for shares to re-rate,” Stevenson said.

Moving back to the US, he suggested tilting towards innovative, high-quality smaller companies and chose Brown Advisory for its “clearly articulated quality-growth approach”.

Managers Chris Berrier and George Sakellaris run a concentrated portfolio and hold stocks for a long time to outlast less patient investors. “They look for well-governed companies with durable growth prospects that can scale up in the near future,” Stevenson explained.

Jason Hollands, managing director of Bestinvest, said if investors are worried about being over-exposed to tech but want to keep a foothold in North America, they could opt for an equally-weighted tracker such as Xtrackers S&P 500 Equal Weight UCITS ETF.

Another option would be a fund using fundamental factors to weight stocks, such as the Invesco FTSE RAFI US 1000 ETF. “This owns the 1,000 largest US-listed companies but weights them based on the four factors of book value, cashflow, sales and dividends rather than market capitalisation,” he explained.

Investors who plan to rotate into overlooked and attractively valued markets might consider Templeton Emerging Markets Investment Trust, Liontrust European Dynamic, Fidelity European Trust, Artemis UK Select and Temple Bar, Hollands added.

How are fund managers responding?

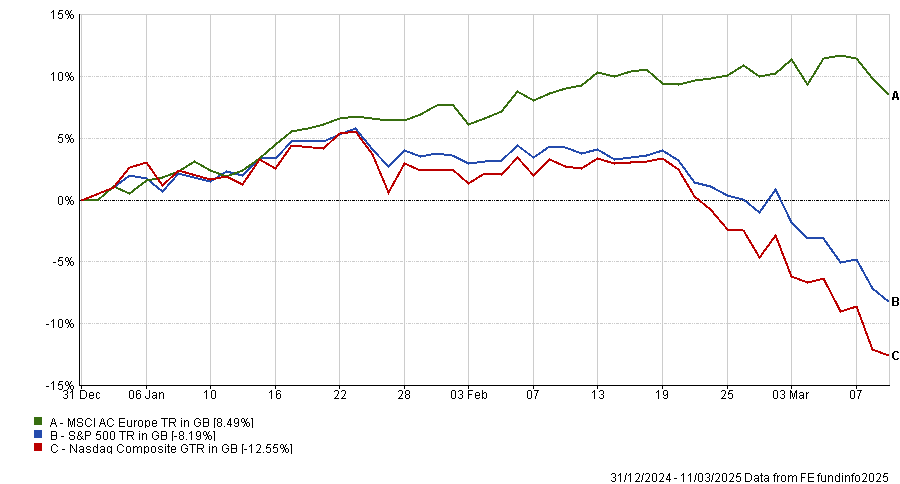

Trevor Greetham, RLAM’s head of multi-asset, is looking for opportunities. “It usually pays to buy when others are fearful”, he said. “We’re modestly overweight equities in our multi-asset funds but with a strong preference for European stocks, which are still up year-to-date, when compared to the expensive US market.”

Performance of European vs US equities, year-to-date

Source: FE Analytics

Hawtin thinks the sell-off was overdue because US equity market concentration, valuations and profit margins are the highest they have been in 100 years.

Performance within the US will continue to broaden out, he said, and the best opportunities will be outside of the ‘Magnificent Seven’ mega-cap tech stocks (although he continues to hold and have conviction in Nvidia and Meta Platforms).

Meanwhile, non-US equity markets offer greater opportunities than the US itself, not least because valuations are more attractive, he said.

In his flagship Liontrust Global Alpha fund, Hawtin has trimmed US exposure to 60% (compared to a benchmark weight of 65%), whereas six to nine months ago, he was overweight the US.

He increased the Global Alpha fund’s Chinese exposure to 7% – more than double the benchmark weight – to take advantage of Chinese companies’ innovation and “incredibly cheap” valuations, backed by government stimulus and support for economic growth.

The European equity market is cheap but it is hard to find good investment ideas there because companies are “bogged down in red tape”, Hawtin noted.

On the other hand, Dan Smith, senior equity analyst at Canaccord Wealth, is keeping faith with America’s tech giants. “Don’t write off the US tech sector just yet,” he warned. “Further selling pressure and a narrowing valuation gap could quickly swing sentiment back in favour of US equities.

“History has shown that mega-cap stocks have demonstrated remarkable resilience to previous sell-offs. The fundamentals of these businesses remain strong and with valuations now less stretched – particularly compared to some European stocks that have enjoyed an incredible run – it is difficult to take an overly bearish stance on their long-term prospects.”

Paul Niven, head of multi-asset solutions EMEA at Columbia Threadneedle Investments, agreed that the Magnificent Seven can continue delivering premium growth but thinks the gap between tech giants and the rest of the market will narrow.

Therefore, he adjusted the F&C Investment Trust’s US exposure last year to achieve an equal balance between value and growth managers, whereas previously it had been overweight growth. The trust uses JPMorgan Asset Management for US growth, Barrow Hanley Global Investors for US value and Columbia Threadneedle for a core mandate.