Emerging markets have been a disappointing sector to invest in over the past decade, as they’ve been severely impacted by the underperformance of Chinese equities, which account for 27% of the index.

The MSCI World Emerging Markets index has made just 75.9% over 10 years, while the developed market MSCI World has risen 223.5%. Much of this is due to China, with the MSCI China index up just 53.2%.

And things do not appear to be getting better, as problems remain. The world’s second-largest economy is struggling to reignite following a Covid dip, while geopolitical and trade tensions with the US and the European Union are on the rise.

For that reason, Charlotte Cuthbertson, co-manager of MIGO Opportunities Trust, a closed-ended fund investing in investment trusts trading at a deep discount, prefers to avoid China.

Instead, she invests in specialist investment trusts focusing on specific countries that appear to be in the emerging market sweet spot of delivering above-average growth, without the pitfalls surrounding their perceived lack of development.

VinaCapital Vietnam Opportunity

One of those countries is Vietnam, which she sees as one of the main beneficiaries of the trade war between the US and China.

This has caused “a lot of companies to diversify away from China,” Cuthbertson said, as political problems and a rise in the cost of labour in China had caused businesses to turn elsewhere.

“Vietnam is not as far on its lifecycle. You still have a situation where manufacturing is increasing, the middle class is growing and urbanisation is expanding,” she said.

To get exposure to this frontier market, MIGO Opportunities Trust invests in VinaCapital Vietnam Opportunity, which it’s the investment company’s top holding.

Although there are other options in the investment trust space to access the Vietnamese market, such as Vietnam Enterprise Investments and Vietnam Holding Limited, Cuthbertson explained that VinaCapital Vietnam Opportunity also holds private equities, which differentiates it from rivals that focus purely on public equities.

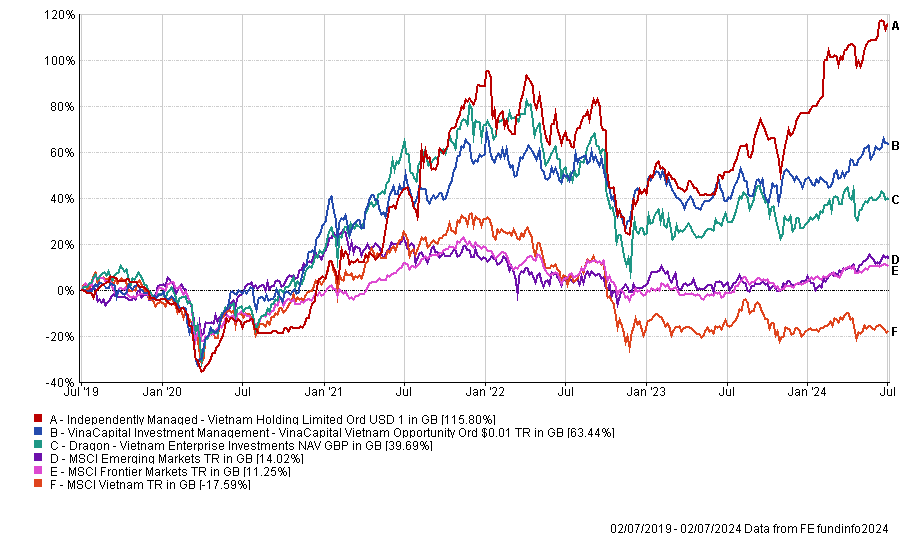

Performance of investment trusts over 5yrs vs indices

Source: FE Analytics

Georgia Capital

Another country in a sweet spot is Georgia and here Cuthbertson uses the Georgia Capital investment trust, which currently trades at a 58% discount.

She explained this deep discount is because it is unknown to many investors as there is little appetite for Georgian private equities, which account for 57% of the portfolio.

Cuthbertson said: “It's perceived by the market as being quite risky, but the underlying investments are performing very well and are very interesting.”

Similar to Vietnam, the middle class in Georgia is growing, meaning that people are spending money on things they couldn’t afford previously, which is a macroeconomic tailwind.

Yet there are also headwinds. For instance, Georgia neighbours Russia and there have been territorial disputes between the two countries in the past – something that has been in the zeitgeist since Russia’s invasion of Ukraine in 2023.

Cuthbertson added: “When Russia invaded Ukraine, there was a lot of nervousness about Georgia Capital because people thought Russia might roll into Georgia as well. That has not been the case, and we did not think it will be because Russia had already seized territories with a majority Russian population during the 2008 war.”

Performance of investment trusts over 1yr

Source: Bloomberg

Georgia Capital was the best performer for MIGO Opportunities Trust in the first five months of this year, but its share price has been hampered by volatility once again, driven by political factors.

The recent political instability stemmed from a new bill called the ‘foreign agents law’, which mandates that non-governmental organisations receiving 20% of their funding from abroad must register as ‘organisations acting in the interest of a foreign power’.

Cuthbertson said: “There have been protests in Georgia, and it has also upset the EU and the US, because it is seen as a Russian-style law. There's been a lot of political noise but we think things will quiet down. There are elections in October, so we don't think the ruling party will want to upset the electorate too much. When things calm down, we should see some recovery.”

JPMorgan Indian IT

Cuthbertson also invests India, citing its stable government, although she recognised this has been “slightly less true” in recent times, as prime minister Narendra Modi no longer holds the same majority he did before the recent elections.

Nonetheless, Indian equities have stood out as superstars among emerging markets, delivering stellar returns that have overshadowed the lacklustre performance of Chinese equities.

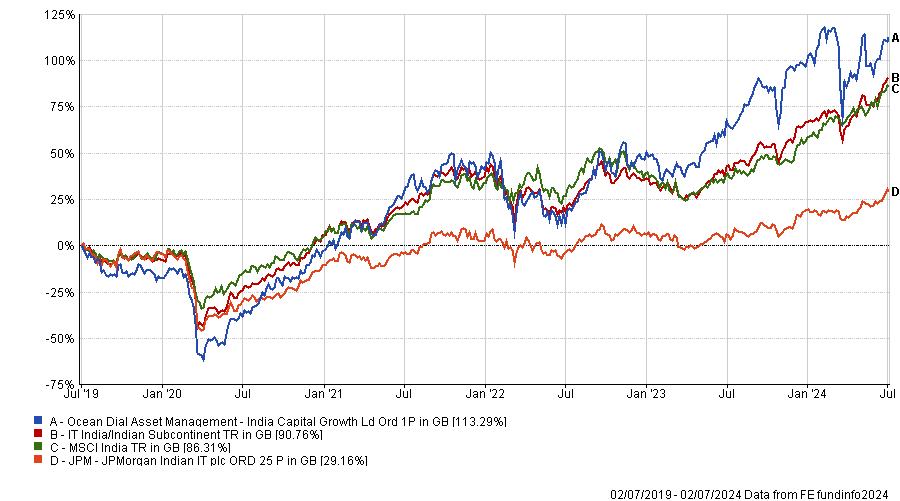

Performance of indices over 5yrs

Source: FE Analytics

As such, Indian equities have gained significant traction among retail investors in recent times as they have been able to keep pace with developed markets.

Until recently, MIGO Opportunities Trust had exposure to the Indian market through India Capital Growth but sold its position a few weeks ago.

Cuthbertson said it was a “very profitable investment”, with the trust buying India Capital Growth at a “a large discount” and holding on to it for “many years”.

“The underlying NAV has increased tremendously and now appears fully valued to us,” she added, highlighting the reason it was sold.

Indeed, after the remarkable performance of the Indian market in the past 18 months, valuations have become very high, particularly in the small- and mid-cap segments, which are areas India Capital Growth specialises in. Some managers of Asia Pacific funds share the same sentiment and recently shifted their investments out of India and into China.

Performance of investment trusts over 5yrs vs sector and index

Source: FE Analytics

However, MIGO Opportunities Trust maintained its exposure to India through JPMorgan Indian IT, which leans more toward large-cap stocks and trades at a double-digit discount. The trust was also added to Numis’s recommendation list at the beginning of the year.